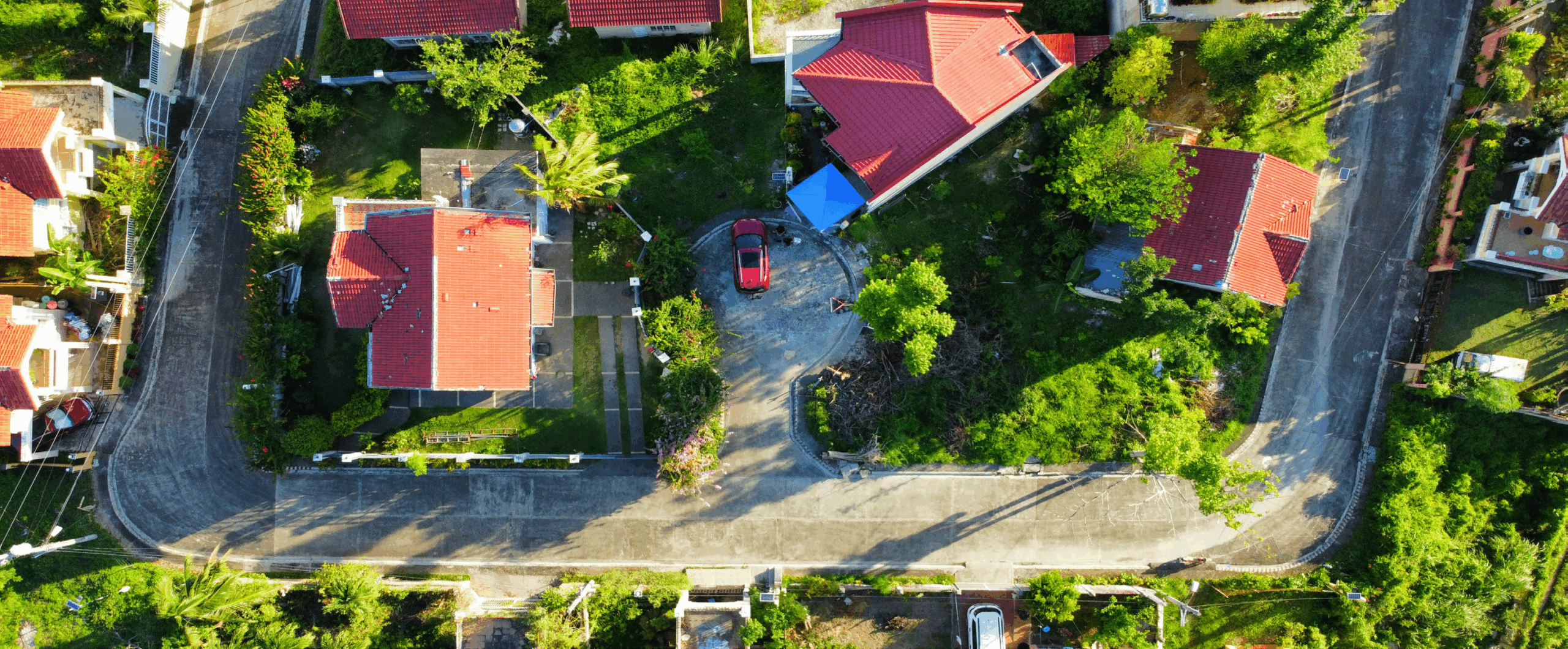

Photo by John Layno on Unsplash

Business Corner is a regular feature presented by UCP Business Manager. The corner will feature articles on Relevant Current business Events, Business essential information and opportunities to showcase a Ugandan business in South Africa.

My intentions were to devote this edition to Banking and Credit Building. However, a recent article by Mr. Moses R. Wilson on real estate investment in Uganda has me thinking otherwise. I decided to write about a whole new set of investment possibilities using the Stokvel model.

I have participated in stokvel activities over the years, especially to help fund my family Christmas holiday expenses. While there have been a few challenges with some participants these activities have proven to be a dependable means of pooling significant amounts of money together (over a specific time window) for a big event.

Interest rates are dropping, and this makes mortgage bonds lower. It is a good time to invest in income properties as rent is increasing while the cost of borrowing (to buy houses) is on a downward trajectory. The biggest obstacle to taking advantage of the current situation is the hefty down payment required for non-South African borrowers (25% for permanent residents and more 50% for non-residents).

A well-crafted Stokvel agreement can help put together like-minded investors to raise the required downpayment and take advantage of the reducing interest rate regime. With a good stokvel base and collaborative effort, an interested person can become a part owner of an income generating real estate for as little as R10,000.

While returns from such investment usually consist of regular distributions from net rental income, and capital appreciation from increase in the value of the property. To get started, depending on how much is needed for the down payment on the target investment property and how large the desired pool of investor is, a stokvel real estate investment can be ready to buy in as little as 6 months.

There must be a least one credit worthy stokvel member who will be the title borrower for the stokvel group. Please note that it is always good to talk to legal and financial advisors before investing large sums of money.

Below is an extract of the article written by Moses R. Wilson

Dear Friends.

Many of you have followed me on my investment journey in Uganda over the past few years. The purpose of my sharing this experience was to demonstrate that such investments are very much possible.

My Camden Park Estates condominium development at Kisugu has been a roller coaster experience. But as I kept reminding myself, if it was easy, everybody would be doing it. I am honestly filled with awe every time I stand at the foot of the building and think back to the days when it was just a grassy hillside. I will confess that this project has severely tested my will, character and fortitude. But I would do it again in a heartbeat…. …, Now, while I do not plan to solicit any outside funding toward the further development of Camden Park Estates, I do want to use this project to promote the creation of a more formal investment vehicle for our community. 3 possibilities immediately come to mind.

- Investment Club: Investment clubs in Uganda are groups of people who regularly pool their money and resources to make collective investments in various asset classes, such as real estate, agriculture, and financial securities. For the most part, Ugandan investment clubs are informal groups, which can restrict their ability to secure loans or expand their operations. Investment clubs do not require professional management but do need competent and trustworthy administration.

- SAACO: In Uganda, a Savings and Credit Cooperative Organization (SACCO) is a member-owned and governed financial institution that pools members’ savings to provide loans and other financial services to its members. SACCOs are registered with the Ministry of Trade, Industry, and Cooperatives and licensed by the Uganda Microfinance Regulatory Authority (UMRA). Although not necessarily required, SAACOs should be managed and administered by professionals.

- Partnership: In Uganda, the main types of partnerships are General Partnerships (GPs), where all partners share unlimited liability for business debts, Limited Liability Partnerships (LLPs), which offer limited liability to partners, and Limited Partnerships (LPs) where some partners having limited liability and are not involved in management, while others remain general partners with unlimited liability. These structures differ in management, liability, and legal standing.

I am not promoting any one of these options over another. But I think the stokvel model has potentials for members of UCP to get into the real estate investment business. Hopefully this article will generate discussions that will lead to some way forward for some members and their friends.

Business Corner

by: Ms. N Lillian